SWIFT codes are widely used to make international banking transactions through online channels. These codes play a significant role in smoothly conducting these financial transactions, but most people are not aware of the use of SWIFT codes in banking.

Therefore, DigitalCruch presents a thorough guide about SWIFT codes in banking and how to find them easily.

What is the SWIFT Code in Banking?

The Society for Worldwide Interbank Financial Telecommunication System, also known as SWIFT, is a messaging infrastructure that financial and banking entities utilize to pass on transaction data safely. This operation conventionally depends on the standard system of codes.

In simple words, the SWIFT payment system, legally S.W.I.F.T. SC in banking, is a structure that enables payments and financial transactions between different banks worldwide. Indeed, it allows individuals and banking entities to conduct international transactions.

This Belgium-headquartered society was founded in 1973, and around 200 countries worldwide are associated with this financial system for making international payments online.

What are SWIFT Codes?

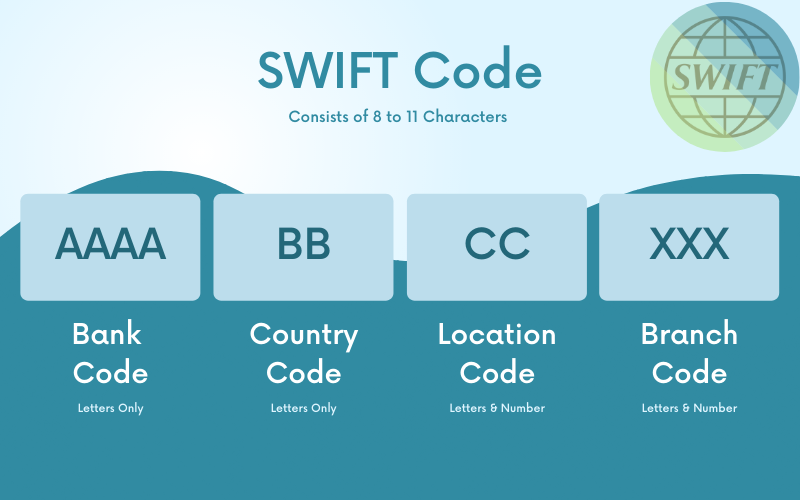

If we are to discuss precisely what SWIFT codes look like, we will have to discuss their core characteristics. The SWIFT code consists of 8 to 11 characters representing bank, branch, country, and city protocols for banking transactions.

What Does A SWIFT Code Look Like?

The format of the SWIFT code could be divided into 4 parts. We are explaining each of them here:

Bank Code

Bank code is expressed by 4 alphabetic characters. Yes, they could be 4 A-Z characters that display the short name of your bank.

Likewise, US Chase Bank’s bank code is ‘CHAS’. Undoubtedly, it is a contraction of Chase.

Country Code

The following two characters are taken from the country code and added to the SWIFT code. Typically, the SWIFT system presents the country code using only two alphabetic letters.

Likewise, the country code of the United States is ‘US’. So, we can say that the bank and country code of Chase Bank will look like ‘CHASUS’. Similarly, the country code of the United Kingdom is ‘GB’.

Location Code

The location code part of SWIFT depends on 2 characters. These 2 characters could be numbers or alphabets or even a combo of both numbers and alphabets. This location code describes the locale of your bank’s headquarters.

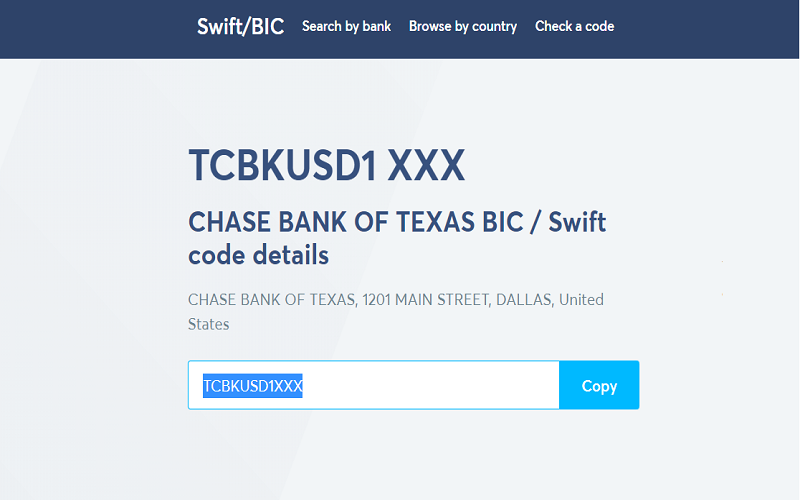

For example, Chase Bank of Texas, located at 1201 Main Street, Dallas, TX, has a location code of ‘D1’. When combined with the bank and country codes, it will look like ‘TCBKUSD1’.

Branch Code

The bank’s branch code in SWIFT consists of 3 alphabetic or numeric characters. Yes, they could be in 0–9 digits, A-Z alphabets or even a combo of both. These characters represent a specific bank branch from where your account belongs.

Typically, all bank branches don’t own SWIFT code, so you can seamlessly proceed with a head office’s code.

How Do I Find My SWIFT Code?

‘How can I find my SWIFT code’ or ‘how to get SWIFT code’ are frequently asked questions when it comes to exploring SWIFT code in banking. Here are the easiest and best ways to find SWIFT code:

1. Ask Your Bank or Use Customer Service

The safest and most straightforward method to find your SWIFT code for international transactions is your bank. You can call your bank’s 24/7 helpline number, and they will provide you with the details of your SWIFT code. Yes, you can rapidly find your bank’s customer service number on Google or in your banking documents.

Similarly, you can also visit the branch, where staff will present the correct SWIFT code. It will only take a few minutes to visit the branch, talk with the branch manager, or inquire about details through the helpline.

2. Bank’s Official Website or App

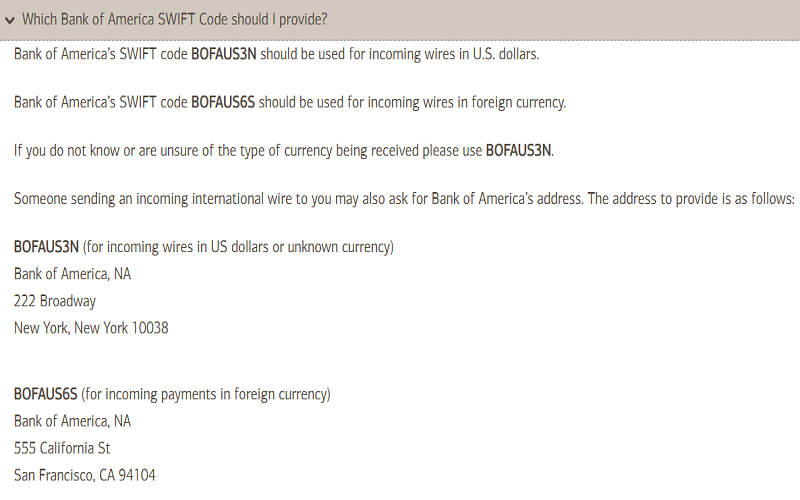

There are several banks in the world that allow account holders to find their SWIFT code through a website or mobile application. Likewise, Bank of America shares its SWIFT Code details in the FAQs section. Bank of America generally uses this SWIFT code ‘BOFAUS3N‘ for incoming wire transfers in USD. However, for foreign currency wire transfers, you can proceed with this code ‘BOFAUS6S’.

3. Find SWIFT Code Online

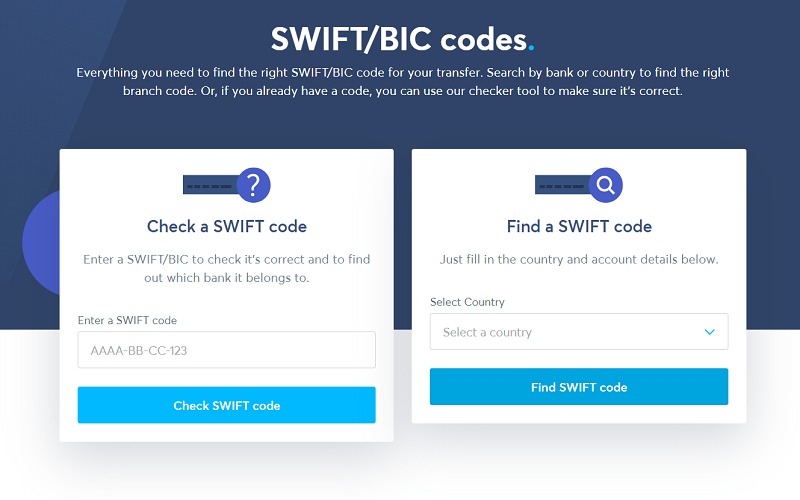

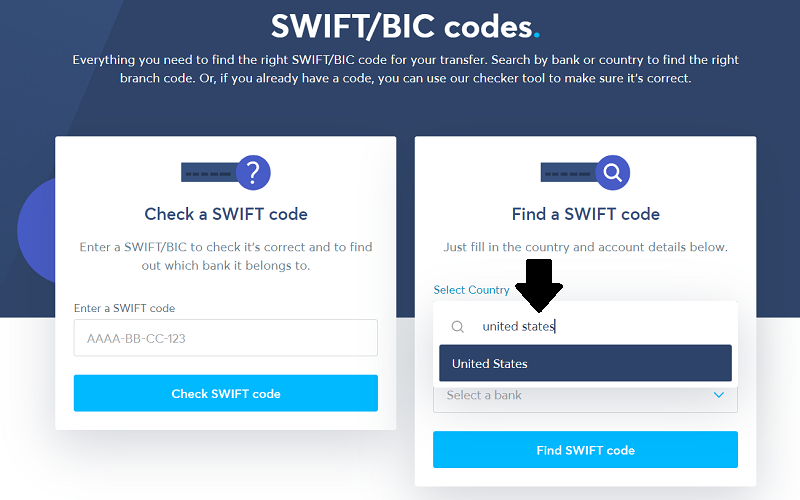

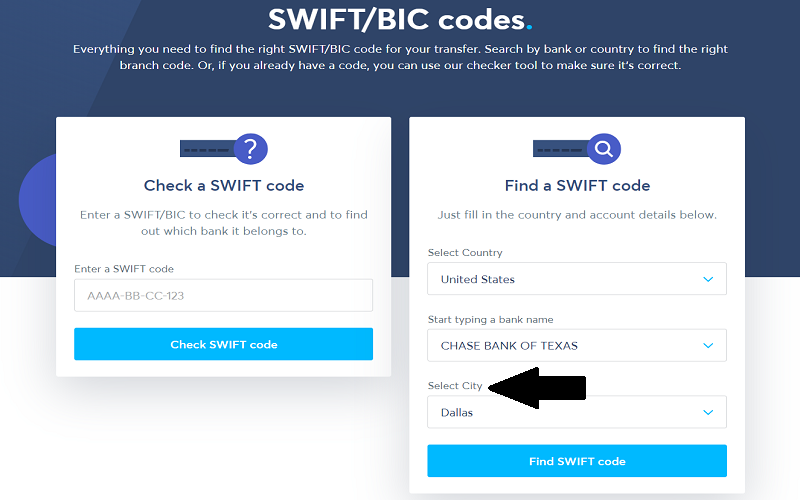

If you want to find SWIFT or BIC spontaneously through an online means, then you should try TransferWise, which is known as Wise. You just need to visit the ‘SWIFT/BIC codes’ page of Wise, and it will present two boxes to you. The first one is about ‘Check a SWIFT Code’ and the second one is for ‘Find a SWIFT Code’.

Find a SWIFT Code

You will have to go with this option and act upon the following instructions:

Select Your Country

Type the Name of Your Bank

Select the City Name

Then Click on ‘Find SWIFT Code’ a Tab in Blue

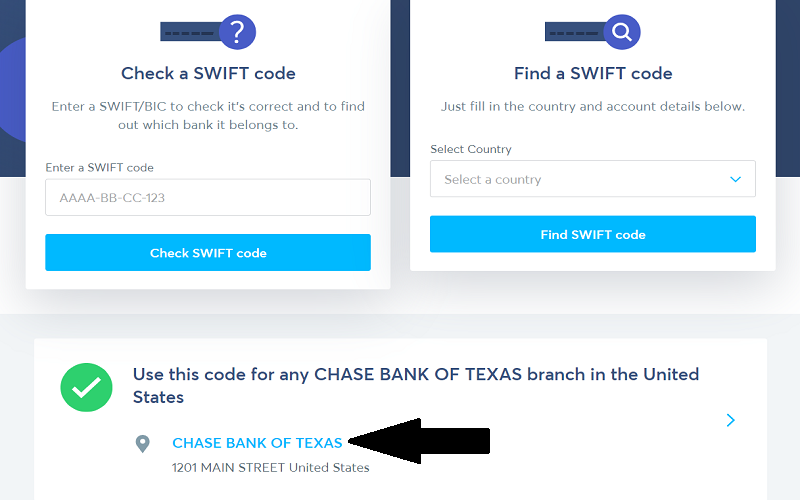

After this last step, Wise will show the complete name of your bank with a branch address and a green tick. If this option is true, you just need to click on it. This source will navigate you to the next page and show an 11-digit SWIFT code. Just copy this SWIFT code and use it where you want to utilize it.

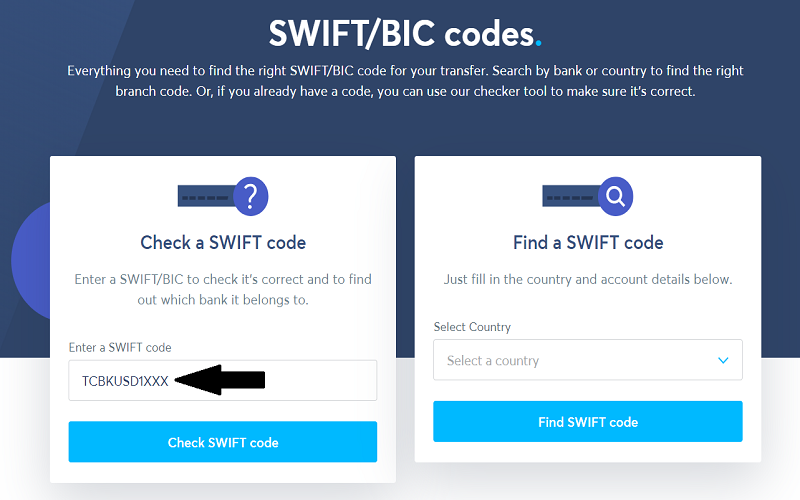

Check a SWIFT Code

The first option on the Wise page is ‘Check a SWIFT Code.’ You can paste the copied code into this box and click on the blue tab.

If your copied code is accurate, it will result in a message like ‘your SWIFT looks right’. So, just use this SWIFT number without any worry.

If you are still confused, cross-check this code with your bank’s customer service representative.

Frequently Asked Questions About SWIFT Code in Banking

Why Do You Need a SWIFT Code?

To send or receive money internationally in your bank account, you need a SWIFT code. That is vital to conducting a successful international interbank transaction. Many other payment methods, such as Single Euro Payments Area (SEPA) and wire transfers, also require SWIFT codes.

BIC & SWIFT Codes Are the Same?

BIC, called Business Identifier Number, is also used to present SWIFT codes. In short, both SWIFT and BIC codes have the same meaning and are used to conduct secure money transfers between international banks.

SWIFT Codes & Routing Numbers Are Same?

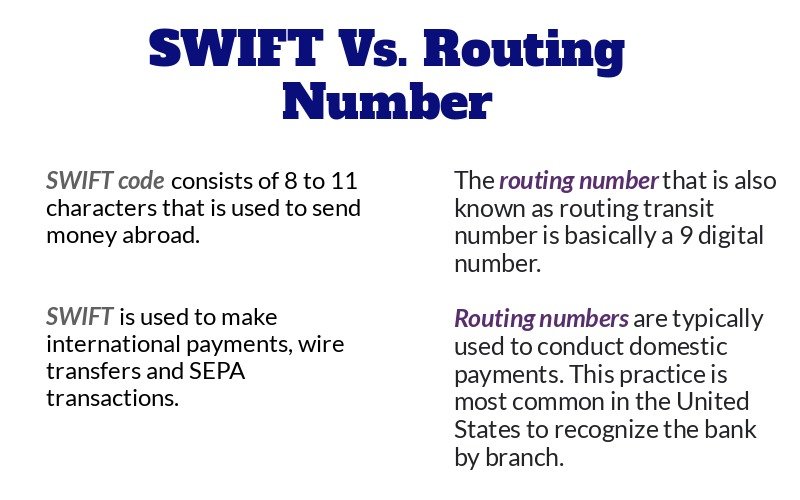

Although the job of SWIFT code and routing number are similar, but they are entirely different.

SWIFT Code: SWIFT code is used to make international payments, wire transfers and SEPA transactions.

Routing Number: The routing number, also known as the routing transit number, is a 9-digit number. Routing numbers are typically used to conduct domestic payments. This practice is most common in the United States, and it is used to recognize banks by branch.

Payment Through SWIFT System Is Safe?

No doubt, SWIFT is a common practice to transfer and receive payments from abroad and can manage 25+ million messages per day. But don’t forget to check your SWIFT code twice or thrice because a single-digit mistake can distract your transaction.

Indeed, there are many chances of human error, mainly when you type the code number, or even sometimes, banking staff can also be wrong.

Therefore, before entering your SWIFT code anywhere, you should cross-check it twice or thrice.

Is It Safe to Share the SWIFT Code with Anyone?

SWIFT code has nothing secret. You can share it with your business organizations and employers without any hesitation. People can quickly generate SWIFT or BIC codes online to make international payments.

Has West Cut Off Russia from the SWIFT Payment System?

Due to the recent conflict between Ukraine and Russia, Western countries have decided to cut off Russia from SWIFT. After this ban, Russian banks will not be able to make global transactions by using SWIFT codes. Yes, the EU has banned around 7 Russian banks from SWIFT. Luckily, the two major banks of Russia, Sberbank and Gazprombank, are not on this ban list because they are major sources of oil and gas.

Final Words

SWIFT is a global payment system financial organizations use for wire transfers, international transactions and SEPA payments. This article thoroughly discusses all the details of the SWIFT code in banking. Yes, you can find the SWIFT payment system here, meaning how to find the SWIFT code in banking and FAQs about the SWIFT System.

If you have more questions about the SWIFT payment system or the SWIFT code in banking, you can share them by commenting below!